Is investing in NFTs still profitable

Introduction:

In recent years, non-fungible tokens (NFTs) have become increasingly popular among collectors and investors alike. These unique digital assets offer the promise of ownership over one-of-a-kind items such as art, music, videos, and even tweets. However, with the rise in popularity of NFTs, there has been a lot of debate on whether investing in them is still profitable. In this article, we will explore the current state of the NFT market and examine some case studies to help you make an informed decision about whether investing in NFTs is still profitable for you.

The Growth of NFTs:

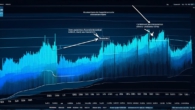

In 2021, the global NFT market size was valued at $439 billion. This represents a significant growth from just a few years ago, when the market was worth only a fraction of its current value. The growth of NFTs can be attributed to several factors, including the rise of blockchain technology and the increasing demand for unique digital assets.

One of the most notable examples of NFTs gaining popularity is in the art world. In 2017, artist Jack Dorsey sold his first Bitcoin as an NFT, marking the beginning of the use of NFTs in the art world. Since then, many other artists have started selling their work as NFTs, including Beeple and Grimes. These sales have generated millions of dollars for these artists, making NFTs a viable way to monetize creative work.

Another industry that has seen significant growth in the use of NFTs is gaming. Many popular games are now using NFTs as in-game currency or items, allowing players to own unique items and assets. For example, NBA Top Shot allows users to purchase and trade NFT cards representing iconic moments from NBA history.

Is Investing in NFTs Still Profitable?

While the growth of NFTs has been impressive, it does not necessarily mean that investing in them is still profitable. The value of NFTs can be highly volatile, with some rare and unique items selling for millions of dollars while others sell for pennies or less. In order to determine whether investing in NFTs is still profitable, we need to examine the current market and consider several factors.

1. Market Trends:

One of the most important factors to consider when deciding whether investing in NFTs is still profitable is the current market trends. In general, the demand for unique digital assets such as NFTs is increasing, which suggests that the market will continue to grow in the coming years. However, it is also important to consider any potential risks or challenges that may impact the NFT market. For example, regulatory changes or increased competition could negatively affect the value of NFTs.

2. Rarity and Uniqueness:

Another factor to consider when investing in NFTs is the rarity and uniqueness of the item. Items with a higher level of rarity and uniqueness tend to sell for higher prices, making them more profitable investments. However, it can be difficult to predict which items will become rare or valuable, as this can depend on factors such as cultural significance, historical importance, and market demand.

3. Market Liquidity:

The liquidity of the NFT market is another important factor to consider when determining whether investing in NFTs is still profitable. If you are able to quickly sell your NFT for a reasonable price, then investing in NFTs may be a viable option. However, if it takes a long time to find a buyer or sell your NFT at a