How can beginners start investing in NFTs

What are NFTs?

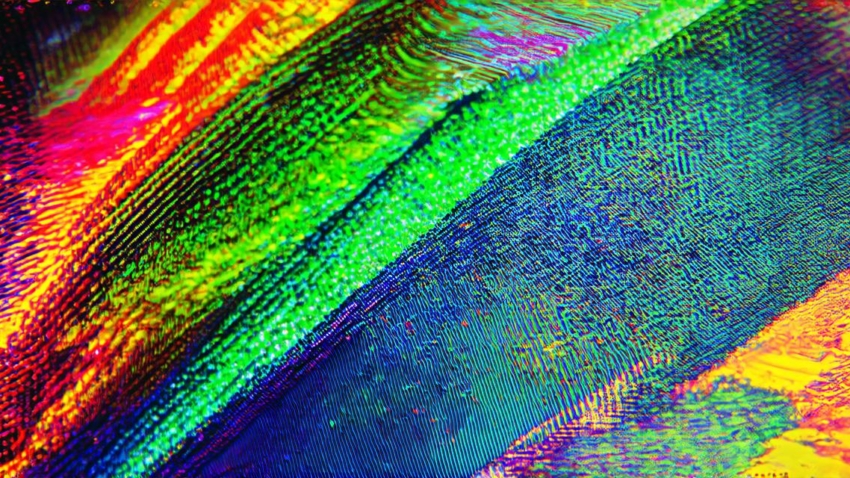

Before we dive into the world of NFT investing, it’s important to understand what NFTs are. NFTs are unique digital assets that represent ownership and authenticity of items such as artworks, music, videos, and other forms of media. Unlike traditional investments like stocks or bonds, NFTs are not interchangeable, making them a unique investment opportunity.

Why Invest in NFTs?

Investing in NFTs has the potential to provide high returns for investors. In recent years, the value of some NFTs has skyrocketed, with digital artworks like Beeple’s “Everydays: All the Dreams I’ve Ever Had” selling for millions of dollars. This is due to several factors including the rarity and exclusivity of NFTs, as well as their potential for appreciation in value over time.

How to Get Started Investing in NFTs

If you are interested in investing in NFTs, there are a few steps you can take to get started:

-

Research and Understand the Market

-

Choose a Platform to Buy and Sell NFTs

-

Set Your Budget

-

Diversify Your Portfolio

Case Studies: Successful NFT Investors

1. Michael Arrington, Co-founder of TechCrunch and CoinList

Michael Arrington has been investing in NFTs for several years and has seen significant returns on his investments. He has invested in a range of NFTs, including digital artworks, collectibles, and even a piece of pizza that was turned into an NFT. According to Arrington, the key to successful NFT investing is to stay up-to-date on new developments in the market and be willing to take calculated risks.

2. Kevin McCoy, Co-founder of OpenSea

Kevin McCoy co-founded OpenSea, one of the leading platforms for buying and selling NFTs. He has invested in a range of NFTs, including digital artworks and collectibles. According to McCoy, successful NFT investing requires a combination of market research, technical expertise, and a willingness to take calculated risks.

3. James Mayo, Co-founder of Rarible

James Mayo co-founded Rarible, another leading platform for buying and selling NFTs. He has invested in a range of NFTs, including digital artworks and collectibles. According to Mayo, successful NFT investing requires a deep understanding of the market and the ability to identify undervalued assets that have the potential for appreciation in the future.

FAQs

1. What are some of the risks associated with investing in NFTs?

Investing in NFTs can be risky, as the value of an NFT can fluctuate significantly. There is also always a chance that an NFT may become worthless or lose its value over time. It’s important to do your research and understand the risks before investing in any asset.

2. How do I store my NFTs?

NFTs are typically stored on the blockchain, which provides a secure and decentralized way to store digital assets. Many NFT marketplaces also provide storage options for NFTs. It’s important to choose a secure storage option that allows you to easily access your NFTs when needed.

3. Can I sell my NFTs at any time?

Yes, you can sell your NFTs at any time on the open market. However, it’s important to note that the value of an NFT can fluctuate significantly, and there is no guarantee that you will get a fair price for your NFTs. It’s always a good idea to do your research and understand the current market conditions before selling your NFTs.

Conclusion

Investing in NFTs has the potential to provide high returns for investors. However, it’s important to do your research and understand the risks before investing in any asset. By choosing a platform to buy and sell NFTs, setting a budget, diversifying your portfolio, and staying up-to-date on market developments, you can increase your chances of success in the world of NFT investing.